SDDFCU, the State Department Federal Credit Union, is a member-run financial institution providing diverse financial services such as savings and checking accounts, car loans, and mortgages.

Governed by a board of directors chosen by its members, SDDFCU ensures competitive rates for loans, credit cards, and additional financial services, while also offering extensive ATM and branch networks.

With round-the-clock account access, financial education, and multiple travel benefits, SDDFCU has been operational since 1923 and is headquartered in Sioux Falls, South Dakota.

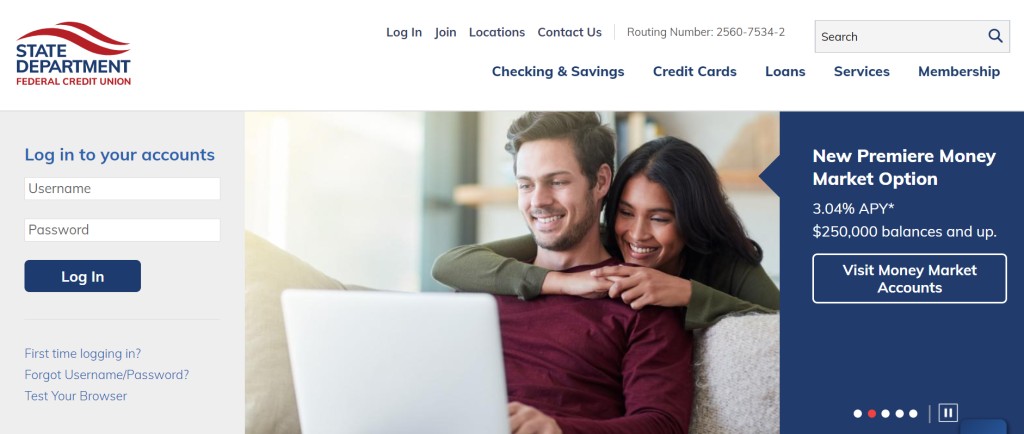

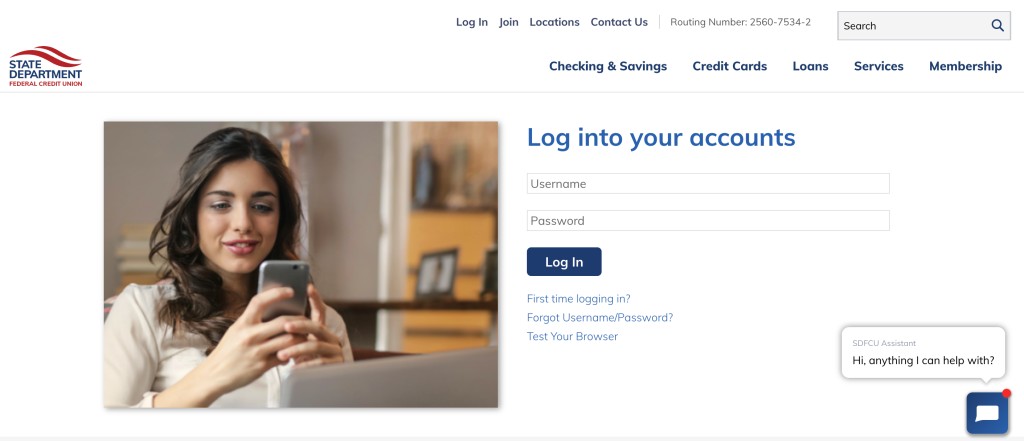

How to Login to SDDFCU?

- Open any of the web browsers and open the https://www.sdfcu.org/login.

- Enter the “Username” and “Password”.

- Click on the login option.

- If you have entered the login details correctly you can log in to your SDDFCU account.

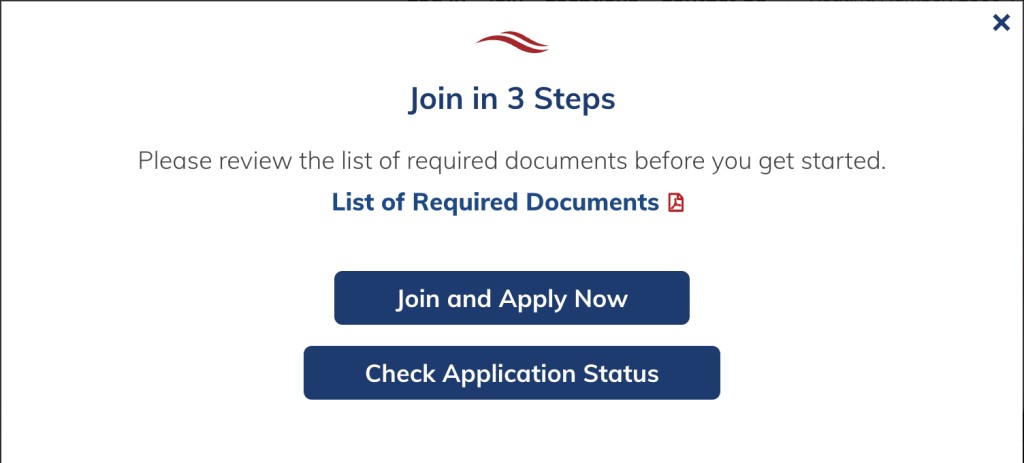

How to Join SDDFCU?

- Visit the website of SDDFCU https://www.sdfcu.org/membership

- Scroll down and click on the “Join SDFCU” button.

- Then a pop-up box will appear.

- Click on the “Join and Apply Now” button.

- Then click on “Proceed“.

- Then choose the type of account you want to open.

- Then fill up the rest of the form.

Why Join SDDFCU?

SDDFCU, a consortium of 14 financial institutions, offers numerous advantages with online banking services.

Among these benefits are:

- A comprehensive selection of financial offerings, including checking and savings accounts, loans, credit cards, and investment services.

- Competitive rates for various financial products, with reduced interest rates on loans and increased interest rates on savings accounts.

- Online and mobile app finance management, featuring useful resources like budget calculators and finance-related message boards.

- Membership in a not-for-profit organization focused on serving its members and local communities.

Features Offered by SDDFCU

- Wide range of account types: SDDFCU offers a variety of account types including savings accounts, checking accounts, and loan accounts. Members can choose the account that best suits their needs and personal finances.

- Low loan costs and higher interest rates: SDDFCU stands out from traditional banking by offering low loan costs and higher interest rates on deposited funds. This feature is especially advantageous for members looking to save and grow their money.

- Online account management: Members can manage their accounts online through SDDFCU’s user-friendly mobile app. This feature allows for easy transfer of funds, bill payments, and balance checking anytime and anywhere.

- Personalized services: SDDFCU prioritizes the needs of their members by offering personalized services and innovative products. Members enjoy competitive rates, 24-hour service, and a cooperative spirit that fosters financial growth and stability.

- Financial education: SDDFCU believes in educating members on financial wellness and offers a variety of resources to help members achieve their financial goals. This feature includes seminars, workshops, and online tools to help members manage their finances more efficiently.

- Quick access: As a member-owned financial institution, SDDFCU provides quick and easy access to available funds without requiring shareholders’ approval. This feature ensures that members can take advantage of their finances whenever they need them.

- Eligibility criteria: To become a member of SDDFCU, members must meet specific eligibility criteria. These criteria require members to be connected to the military or diplomatic community or work in relevant fields.

- Member ownership: As a member-owned financial institution, SDDFCU prioritizes its members’ needs and financial well-being and promotes community engagement and financial education through a cooperative spirit.

- Low debt: SDDFCU provides a monthly fee-free checking account, ensuring members don’t have to pay additional fees to maintain their account or use their debit card.

- Difference between banks and credit unions: SDDFCU differs from traditional banks in that they prioritize their members’ needs above making a profit for shareholders. They also offer low loan costs and higher interest rates to help members save and grow their finances.

Pros & Cons of Using SDDFCU

Pros:

- Gain access to numerous financial offerings, including checking and savings accounts, loans, credit cards, and investments.

- Benefit from competitive rates, including low-interest loans and high-interest savings accounts.

- Utilize online and mobile app management, with tools like budget calculators and finance discussion boards.

- Join a member-focused, not-for-profit organization serving local communities.

- Apply for holiday personal loans to cover expenses like gifts and travel.

Cons:

- Lack certain features and benefits offered by larger banks, such as branches, ATM networks, or cash deposits.

- Experience longer processing times for transactions like deposits, withdrawals, or transfers.

- Need to satisfy eligibility criteria to join one of the 14 SDDFCU-affiliated financial institutions.

- Risk losing cashback rewards if closing accounts prematurely or making ineligible transactions.

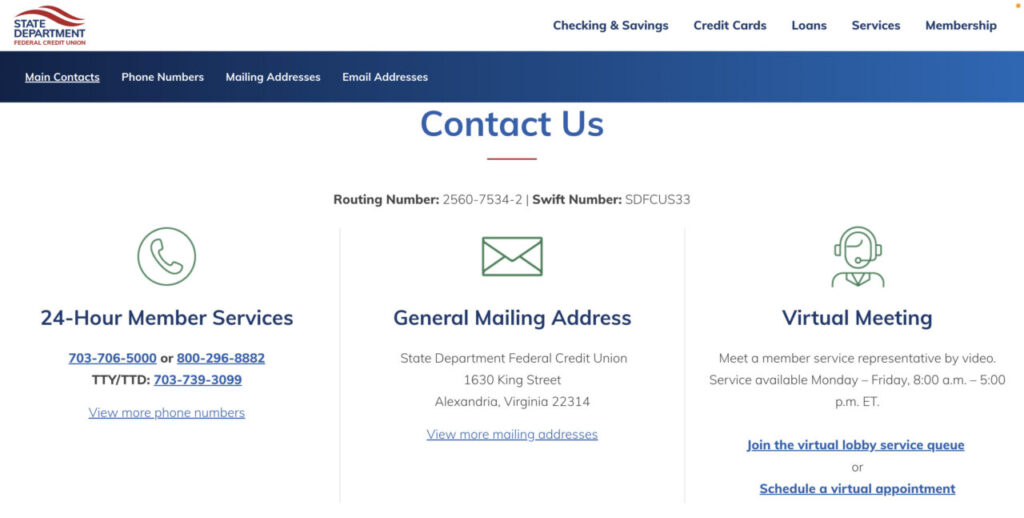

SDDFCU Customer Service

To contact SDDFCU customer service, you need to contact the customer service of the specific financial institution that you are a member of.

- Call 800-296-8882 or 703-706-5000 for general inquiries.

- Email [email protected] for general inquiries or [email protected] for card services.

- Visit https://www.sdfcu.org/contact-us to fill out an online form or chat with a representative.

- Visit one of their branches in Washington DC, Virginia, or South Carolina.