It is becoming very common to invest in mutual funds with a systematic investment program or SIP. Read on to learn why this is such a great way to invest in mutual fund funds.

A systematic Investment Plan, or SIP, is a way to invest money in mutual funds. Another way to invest is a lump sum or one-time payment.

The Best SIP Funds list is comprised of mutual fund schemes that have provided better SIP returns than other Funds within the same category. These Funds are able to stick to their investment strategy in times of difficulty and don’t fear temporary corrections in stock prices. This allows them to generate higher long-term returns for their SIP investors.

Looking for the Best SIP plans? How to choose them? These are some of the common questions that occur in the mind of investors when thinking of Investing in Mutual Funds through a SIP. So let’s start this from the beginning.

What are Mutual Funds?

Mutual funds are one of the most common investment options these days. But Mutual funds can be intimidating or confusing to many people. We will simplify it for your convenience. A Mutual Fund is basically the sum of money that has been pooled by many people (or investors). This fund is then managed by a professional fund manager. According to Statista, an increasingly important role is being played by mutual funds in financial markets, with the number of open-end funds worldwide increased by nearly 40% from 2011 to 2019.

It’s a trust that collects money from investors who have a common investment goal. It then invests the money into equities and bonds, money market instruments, and/or other securities. Each unit represents a percentage of the fund’s holdings.

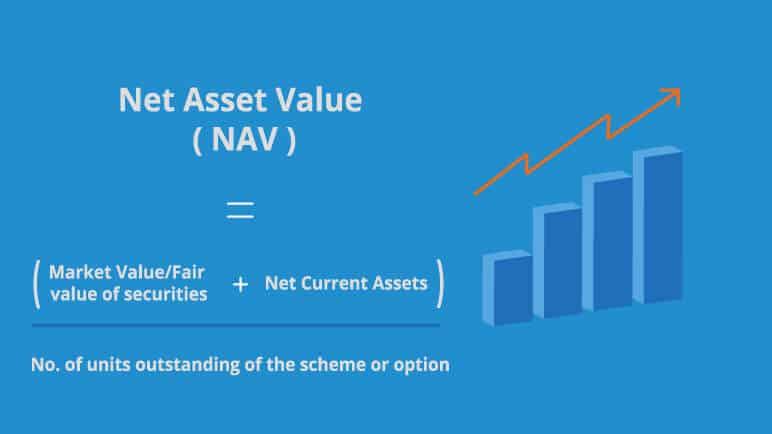

After deducting certain expenses and calculating the scheme’s Net Asset Value or NAV, the income/gains from this collective investment are divided proportionally among the investors.

What is SIP?

A Systematic Investment Plan, or SIP, is a hassle-free way to invest money in a fixed sum in mutual funds. Another way to invest is a lump sum or one-time payment.

SIP allows you to invest a set amount each month in mutual funds of your choice. You set it up so that money is automatically deducted from your bank account. Use the SIP calculator to determine how much monthly SIP you will need to invest in order to reach a specific goal.

You can purchase units at a specific date each month to help you implement a savings plan. You can set aside a predetermined amount to invest at certain intervals (quarterly, monthly, or weekly). This plan has the greatest advantage of instilling the habit of saving so that the user can begin to build a solid fund for the future.

SIP investing is one of the best ways to invest in Mutual Funds. SIP mutual funds allow you to invest as little as INR 100. This makes SIP easy to invest in.

Why Invest in a Systematic Investment Plan (SIP)?

There are many benefits to a systematic investment plan. The minimum investment amount of INR 500 is what attracted most people’s attention. It also encouraged many young people to start their mutual fund investment journey. A SIP allows investors to plan their major financial goals, such as a child’s education, marital expenses, and purchase of a home/car. You can start investing according to your goals (short-term/mid-term and long-term) and see an increase in wealth over time.

Advantages of SIP:

- Rupee cost averaging

- You can invest a small sum

- Flexibility

- You can run multiple SIPs at a time

- You Can Stop the SIP Anytime

- You Can Skip SIP Payment

- You Do Not Need to Worry About Timing the Market

SIPs have major advantages like rupee cost averaging or Power of Compounding. Rupee cost average allows an individual to calculate the total cost of an asset purchase. A SIP is a method of purchasing units over a long time period. These units are usually spread over equal monthly intervals. The investment is spread over time so that the price points are different. This gives the investor the advantage of averaging costs, hence the term rupee-cost averaging.

In the situation of compound interest, in contrast to a single interest, where you simply earn interest in the principal, here the interest amount is added to the principal and interest on the new principal computed (old principal plus gains). This process is always ongoing. The mutual funds in the SIP are complemented by installments, which increases the amount invested initially.

How to Invest in a Systematic Investment Plan?

- Open a Lifetime Investment Account.

- Complete your Registration Process and KYC.

- Upload Documents (PAN, Aadhaar, etc).

- And, Now You are Ready to Invest!

Best Performing Mutual Funds for SIP

| Fund Name | Min. SIP | Type of Fund | 1 Year Returns | 3 years Return | 5 years Return |

|---|---|---|---|---|---|

| ICICI Prudential Technology Fund | ₹100 | Equity Sectoral | 108.10% | 37.40% | 32.70% |

| TATA Digital India Fund | ₹150 | Equity Sectoral | 109.10% | 34.40% | 32.70% |

| Parag Parikh Flexi Cap Fund | ₹1000 | Equity Flexi Cap | 54.20% | 24.50% | 22.00% |

| SBI Small Cap Fund | ₹500 | Equity Small Cap | 67.40% | 21.10% | 23.00% |

| Axis Midcap Fund | ₹500 | Equity Mid Cap | 64.40% | 23.30% | 22.00% |

| Axis Bluechip Fund | ₹500 | Equity Large Cap | 51.30% | 19.40% | 19.00% |

| Kotak Bluechip Fund | ₹100 | Equity Large Cap | 55.30% | 17.70% | 16.00% |

| Mirae Asset Large Cap Fund | ₹1000 | Equity Large Cap | 50.90% | 16.90% | 17.40% |

| Mirae Asset Hybrid Equity Fund | ₹1000 | Hybrid | 42.60% | 16.80% | 16.30% |

| Nippon India large Cap Fund | ₹100 | Equity Large Cap | 54.90% | 12.70% | 14.70% |

Things You Need To Know Before Starting a Systematic Investment Plan

Have fun investing!