A PPF calculator is an easy tool to figure out the returns on your investment in a Public Provident Fund. It shows what your investment will yield over the years. All you need to do is specify how much you intend to invest initially, how frequently you will make subsequent deposits, and the current interest rate, which is 7.1%. For illustrative purposes, we assume your total earnings will be calculated after a minimum period of 15 years. With such clarity, you can plan your financial objectives while relying on precise estimates from your PPF account instead of manual calculations.

What really is ppf?

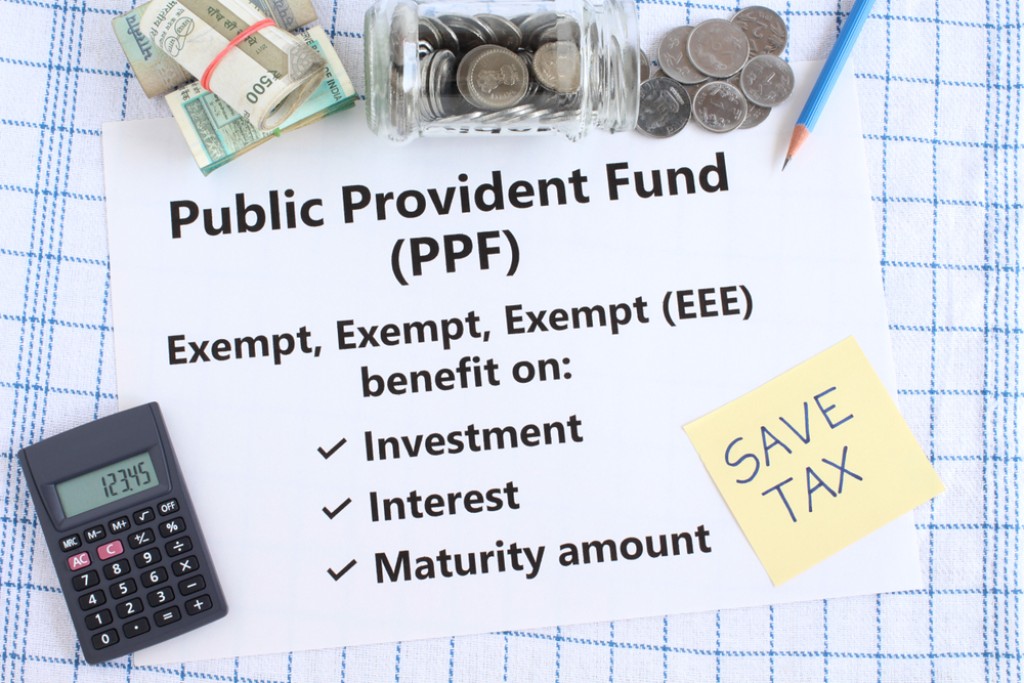

The goal of the ppf, which was first implemented in the country in the year 1968, was to mobilize tiny contributions for investment and return. It can even be referred to as an investment vehicle that simply enables you to accumulate retirement funds at the same time reducing yearly taxes. A ppf account should be opened by anybody who is looking for a secure investment alternative to diminish taxes and earn assured profits.

It would not be wrong to say that ppf is one of the finest and popular investing options for the ones with a limited tolerance for risk. Ppf is a government-sponsored type of scheme and the investment is somewhat unrelated to the market. As a result, it offers you guaranteed returns to meet your needs for safe investments. Ppf accounts diversify an investor’s portfolio because their returns are somewhat fixed. They even offer advantages for tax savings. Of course, you can be sure that you get the returns you aspired for with ppf.

Using a calculator for ppf

Well, a ppf type of calculator helps users like you plan your financial goals by giving you an estimate of returns based on the sum you invest and the duration. The calculator makes use of a 15-year tenure and the overall prevailing interest rate to compute the general returns as a standard procedure.

Withdraw of ppf amount

Well, you can entirely withdraw from a ppf account only upon maturity or even after 15 years of running the account. After 15 years, an account holder may withdraw the complete balance in the ppf account, including the interest earned, and even the account can be terminated. However, in case ppf holders need money for any emergency, the scheme allows the partial type of withdrawals beginning in the seventh year or after the account has finished six years.

The Calculator Makes Things Easier

If you are a layperson and you know nothing about how to do calculations of your ppf and all then relax. The ppf oriented calculator is there to help you make the right move. It ensures that you have a proper understanding of all the interests and everything that you may get over the period of time. Hence, you can make proper moves.

Conclusion

To sum up, why stay doubtful about your interests and other things when you can use a calculator to ensure you know what exactly you are doing? Of course, a calculator for ppf is going to be really helpful for you in decision-making.