When considering the cryptocurrency market, you may have hundreds of questions. After all, cryptocurrency is still relatively new, and understanding its processes can be overwhelming.

In this guide, we’ll fill you in on what to know about cryptocurrency. That way, you can choose the best cryptocurrency for your portfolio and plan your investments wisely. There’s never been a better time to invest!

What to Know About Cryptocurrency

You could fill volumes with all the information currently available on cryptocurrency. Consequently, learning the basics can feel like an uphill battle.

Still, beginners can make things simpler by asking four questions:

- What Is Cryptocurrency?

- How Many Cryptocurrencies Exist?

- How Do You Invest in Cryptocurrency?

- How Can You Make Profitable Investments?

These four questions are the most essential to ask when getting to the cryptocurrency market. By answering these questions, you can form a solid foundation to build upon, ensuring you make the best possible investments. Payday loans are a common source of funding for newcomers to the cryptocurrency market.

Check Also: Bad Credit Loans Online with DimeBucks

What Is Cryptocurrency?

Cryptocurrency is a term that essentially means ‘virtual currency.’ Bitcoin, created in 2099, is often considered the first cryptocurrency. It remains one of the most popular options for traders and investors.

Most retailers do not accept cryptocurrency-based payments for goods and services. However, quite a few online stores do accept Bitcoin. As such, much of the cryptocurrency market is still synonymous with Bitcoin.

One of the hallmarks of cryptocurrency is that it’s generated via cryptography. According to Investopedia, cryptography is a way of encoding and decoding data using complex mathematical structures.

Computers, originally built to perform calculations, are excellent tools for cryptography. As such, we wouldn’t have cryptocurrencies without computers.

In fact, computational functions are at the heart of cryptocurrency. But to understand this process, we’ll need to take a moment to discuss how cryptocurrencies work.

How Does Cryptocurrency Work?

Cryptocurrencies work in a variety of ways. Some are based on data mining, while others are based on fiat currencies. Still, more are based purely on social media representation.

As such, some cryptocurrencies work by simply generating interest and convincing investors to deposit their money. But the most popular cryptocurrencies are generated via specific computer processes.

Generally, the two most popular methods of generating cryptocurrency are blockchain operations and crypto mining. If you’re unfamiliar with these concepts, you’ll want to brush up before making your first investment.

What Is a Blockchain?

Put simply; a blockchain is just a database. Its name derives from the fact that it stores information in large blocks, which are chained together.

Blockchains are a crucial part of modern financing. This is because they can store vast amounts of information that’s shared between multiple parties. As such, they’re often utilized as virtual ledgers.

What Is Crypto Mining?

Operators that build blockchains are known as crypto miners. By allowing your computers to process vast amounts of information and build blockchains, you could create new Bitcoins.

Most crypto miners function solely in the realm of Bitcoin. The bitcoins they generate by creating blockchains are often immediately deposited into a personal digital wallet.

Still, mining for bitcoins can be a costly and time-consuming process. As such, it’s often better to make smart trades than to set up a crypto mining rig.

Does Cryptocurrency Have a Direct Value?

Unlike currencies based on the gold standard, cryptocurrencies do not directly value precious metals. They’re considered void of intrinsic value. In this way, cryptocurrencies differ from standard currencies.

That said, some cryptocurrencies (like Tether) are tied to real-life currencies. But most don’t function in the same way that a common stock might.

When you purchase a business’s stock, you’re partially investing in the future growth of that company. But when you purchase cryptocurrency, you’re investing in the potential growth of that currency.

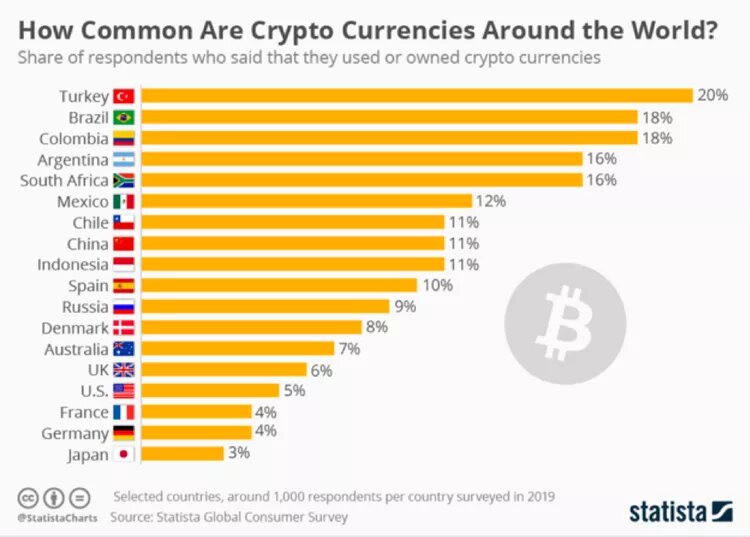

As such, social media and global awareness can have significant impacts on cryptocurrency values. Essentially, the more people who decide to invest in any one cryptocurrency, the stronger it will become.

Conversely, if a large number of people decide to cash in their cryptocurrency, the price for that currency might plummet. This is because investors primarily drive the cryptocurrency market.

How Many Cryptocurrencies Exist?

There are thousands of available cryptocurrencies, and choosing the best option for your virtual wallet can be frustrating. Cryptocurrencies range from the massively powerful Bitcoin to the quirky little-known Cthulhu Offerings. According to Investing.com, there are 5,972 cryptocurrencies today. After the creation of bitcoin, the number of cryptocurrencies available over the internet is still growing at a huge rate.

When you’re first beginning to trade, you may want to invest a minimal amount of funds into smaller currencies. However, you might also prefer to make a large investment in a well-known cryptocurrency.

According to Forbes, some of the top cryptocurrencies are:

- Bitcoin

- Ethereum

- Tether

- Dogecoin

Let’s take a quick look at these top options to discover how valuable they might be and why they attract so many investors. This way, you can pick a cryptocurrency tailored to your risk level and budget.

Bitcoin

Bitcoin is the largest and most profitable cryptocurrency. As a result, a wide number of online retailers also accept it. However, purchasing a bitcoin can be challenging for beginner-level investors with little capital.

The price for a single bitcoin varies, but it’s often well over $1,000. Still, if you can afford a bitcoin or have noticed a dramatic drop in Bitcoin values, it might be worthwhile to invest.

Ethereum

Remember when we mentioned blockchain? Well, Ethereum might be the most well-known blockchain platform. But it’s also a cryptocurrency.

This cryptocurrency trades in non-fungible tokens (NFTs). An NFT is a virtual coin, but it’s also a unit of data. Some of the most infamous NFTs have thus far have been one-of-a-kind images.

As such, Ethereum holds a greater value and appeal than other cryptocurrencies, especially to investors interested in collecting digital art. The fact that Ethereum tokens have a subjective value makes them unique.

Tether

This cryptocurrency distinctly mirrors real-life currencies, differentiating it from competing cryptocurrencies. For example, a Tether Token (USDT) is backed by the US Dollar.

Investors that would prefer to operate in a more stable market may want to invest in Tether Tokens. These are a form of stablecoin, a less volatile alternative to other cryptocurrencies.

Dogecoin

Firstly, it’s crucial to note that there’s a ton of controversy surrounding Dogecoin. Most serious investors completely ignore Dogecoin, one unit of which is a DOGE. That’s because a DOGE typically costs less than one USD.

However, this cryptocurrency has a huge fan following and social media presence. As a result, its value fluctuates wildly, making it one of the more volatile options.

But Dogecoin is an affordable alternative to other currencies. So if you’ve little money to invest in your first cryptocurrency, you could do far worse than invest in a handful of DOGE.

How Do You Invest in Cryptocurrency?

Now that you’re familiar with some of the top dogs in the cryptocurrency market, you might be wondering how to make your first investment. Fortunately, investing is a relatively straightforward process.

To get started, you’ll need to:

- Choose a Trading Platform

- Purchase Your First Cryptocurrency

- Consider Helpful Tools

Let’s analyze these steps in greater detail so that you can make a flawless entry into the cryptocurrency market. After all, when you know what to expect, you’re less likely to make beginner-level mistakes.

Choose a Trading Platform

As you might imagine, the first thing you’ll need to do is choose a trading platform. Without one of these, you’ll likely struggle to find, acquire, trade, or sell currencies. But there are dozens of popular platforms.

Coinbase and Binance are two popular options, but you’ll want to investigate multiple platforms before opting for one. If you’re unsure where to start, try perusing a helpful comparison chart of features and prices.

After you’ve picked one that appeals to your needs and preferences, you’ll need to create an account. You might also see a prompt for a platform tutorial.

Go ahead and follow that prompt, as it will likely lead you to your first investment. But, of course, if your platform doesn’t walk you through the site upon registration, you can always head directly to the trading page.

Purchase Your First Cryptocurrency

To buy your first coin or token, you’ll need to ensure you have a digital wallet available. Most cryptocurrency trading platforms offer a free virtual wallet to users, so you may not need to look far to find it.

If possible, go ahead and set up an encrypted key for your wallet. This will help keep your assets safe from hackers and scammers. Of course, you can also choose to invest in a cryptocurrency wallet.

Once you’re certain that your wallet is functional and safe, you can choose a cryptocurrency. The best option for you depends on your budget and your preferences. Volatile options can be exciting but costly.

The precise purchase process differs from platform to platform, but most offer easy point-and-click buying tools for traders. As such, the greater challenge might be choosing a currency!

Consider Helpful Tools

After purchasing your first cryptocurrency, you’ll want to watch the markets and consider additional investments. However, if your schedule is already jam-packed, you might not have time to maintain your cryptocurrencies.

You may also struggle to understand why values change or how to anticipate market changes. Additionally, keeping your coins and token together in one easy-to-manage location can be challenging.

Fortunately, there are plenty of helpful tools for cryptocurrency investors. For example, you can use automated trading bots, delve into helpful educational resources, and invest in useful devices to keep your coins safe.

Still, tools alone won’t assure your success. But they sure can help you make the most profitable investments!

How Can You Make Profitable Investments?

Before discussing how you can make profitable investments in the cryptocurrency market, it’s crucial to point something out. Cryptocurrency has no intrinsic value. The market is one of the most volatile for investors.

As such, the average investor isn’t likely to become a millionaire overnight after investing in cryptocurrencies. That said, there are ways of increasing the profitability of your crypto portfolio.

To maximize your earning and trading potential, you’ll want to:

- Follow the Market Closely

- Put Time Into Continuing Education

- Use a Trading Bot

- Invest in a Crypto Wallet

While these options might not guarantee success, they can increase the likelihood of profitable trades, fewer losses, and safer coin storage. That’s why it’s worthwhile to at least consider the following tips and tricks.

Follow the Market Closely

One of the best things you can do for your cryptocurrency wallet is to follow the market closely. Values can change drastically overnight, leaving you feeling crushed or elated come morning.

But by paying close attention to trends and social media, you can anticipate changes in the market and make timely trades. There are several market watch services, so be sure to choose one that makes sense for your devices.

Put Time Into Continuing Education

There’s a lot to learn about cryptocurrencies, and new information is published every day. If you’re determined to become a skilled trader, you’ll want to continue learning about cryptocurrencies.

There are tons of resources available online, and many platforms offer in-platform learning materials. However, if your chosen platform doesn’t have many helpful lessons, you can try this Udemy Cryptocurrency course.

For a reasonable price, you can gain lifetime access to nearly ten hours of on-demand video lessons that cover a wide variety of topics. If you’re new to trading, this course could help you feel more confident.

Use a Trading Bot

If you have a hectic schedule that doesn’t allow you to watch the cryptocurrency market closely, you may want to consider using a trading bot. A trading bot could make automated trades throughout the day.

Of course, trading bots differ from provider to provider. But most allow users to set specific limits on currency values and trading points. As such, a trading bot could help you maintain your currencies.

Still, even the most knowledgeable traders can suffer surprising losses without the help of a crypto wallet. This unique device is essential to investors that need to keep their coins safe and manageable.

Invest in a Crypto Wallet

Keeping your virtual coinage safe and manageable can be tricky, especially if you operate on multiple platforms. But a high-quality cryptocurrency wallet could change the game—fortunately, the Safepal S1 in Stock right now.

It’s one of the top-of-the-line digital wallets for cryptocurrency traders, storing more than 10,000 cryptocurrencies. Instead of scrolling endlessly through your many coins and currencies, you can select its icon.

This device uses Safepal software and can connect to your preferred VPN. This ensures that the Safepal S1 is one of the most secure and compatible cryptocurrency wallets available.

Learn How to Invest in Cryptocurrency Today

Now that you’re familiar with what to know about cryptocurrency, you can begin making smart investments. Taking the first few steps into the cryptocurrency market can feel overwhelming, but a little info can help.

Cryptocurrency markets change with every passing hour, and new cryptocurrencies are popping up all the time. To continue your education, you’ll want to stay up-to-date with currencies and values.

If you’re curious to learn more about personal finance, be sure to check out our related articles now!