In terms of practical applicability, bitcoin is no different from any other high-risk investment. This implies that your decision to invest or not depends on your risk tolerance and investing objectives. Are you concerned about the disadvantages of bitcoin? If you replied yes, you should also be aware of its benefits, as this will help you make an informed choice about whether to invest in Bitcoin or not. Before investing in bitcoins, you have the right to become fully informed about the currency. You should be informed of the many pros and downsides of investing in Bitcoin. Two of the most critical are security and protection.

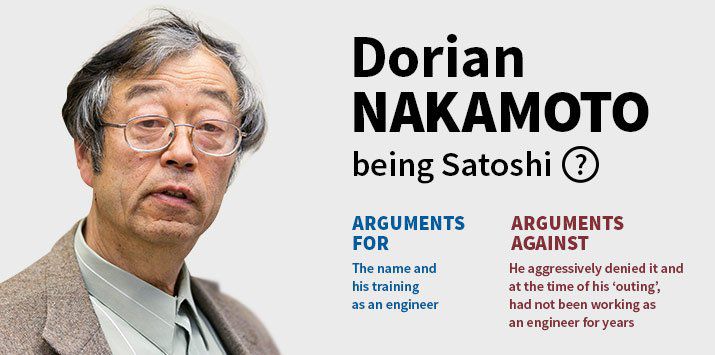

Bitcoin, the world’s first decentralized digital money, is widely viewed as a revolution in today’s currency and financial systems. Bitcoin was founded in 2009 by an unidentified programmer named “Satoshi Nakomoto”. Bitcoin (BTC) is a cryptocurrency that is built on top of a blockchain, which is a decentralized ledger that is impenetrable to tampering.

As a result of industrialization and technical advancement, virtual currencies are gaining a competitive edge. Bitcoins are an example of this type of cryptocurrency. Many of us are definitely familiar with this well-known jargon. Cryptocurrency is the one thing that baffles me. What are the advantages and disadvantages? Is investing in 2022 worthwhile? If you have any such questions, they can be answered here.

Everything in the world has both advantages and disadvantages. Similarly, cryptocurrency has a number of pros and disadvantages. If you’re worried about cryptocurrency’s downsides, we guarantee that once you learn about the benefits, you’ll quickly forget about them and invest in bitcoin. However, before investing in cryptocurrencies, it is necessary to get a thorough understanding of the bitcoin currency.

Pros And Cons of Investing in Bitcoin Cryptocurrency

| Advantages Of Bitcoin | Disadvantages of Bitcoin |

|---|---|

| Possibility of high returns. | Volatility is high, and there is a risk of big losses. |

| Security Against Payment Fraud. | Use in the black market. |

| International Transactions with Immediate Settlement. | It’s completely unregulated and uncontrolled. Chance of cyber hacking. |

| Increasing Liquidity and Diversification. | No refund. |

Pros and Cons of Investing In Cryptocurrency

Before investing in or trading in bitcoin, there are a number of important pros and cons of investing in cryptocurrency to take into account. Both of these issues will be addressed in this section, which will alleviate many of your concerns. We did our best to obtain the data from reliable news sources like Wazirx, Coindesk, Coinswitch, Cointelegraph, and others on cryptocurrencies and the opinions of experts.

Pros

Privacy of Individual’s Personal Data

If you wish to pay with a credit card, you should provide your credit card to the merchant. To make a payment, you must supply the merchant with your pin code. Which approach do you think is the safest? It goes without saying that your pin code is strictly confidential, and you have no obligation to share it with anybody. Cryptocurrencies don’t have this issue. If you don’t want anyone to know your private key, don’t. No one will be able to see your payment information, and it will never be shared or sold to a third party. Thus, it is the best way to conduct anonymous transactions.

Transactions in Real-Time and With Complete Security

You have a valuable asset in your digital wallet if you have cryptocurrency. It’s easy to provide it to anyone, even if they don’t have your permission. To complete the transfer, you’ll need the recipient’s private key. You don’t have to pay anything, go through any hassle, or provide any papers in order to transfer ownership. However, as compared to other circumstances, such as the transfer of a property or the closure of a bank account, you will have to deal with a lot of paperwork and pay a fee.

Characteristics that make them resistant to inflation

Several currencies’ values have declined over time as a result of inflation. Every new coin has a set supply when it is first issued. There are only 21 million Bitcoins in the world, and the source code specifies the number of each currency. To stay up with the market and prevent inflation, its value rises as demand increases.

There is no need for a mediator

Bitcoin’s primary benefit is that it is decentralized. There are several cryptocurrencies that are controlled by the developers who use them and those who hold a big amount of the money, or by an organization that produces the currency before it is released to the public. Decentralization prevents a single institution from having control over the movement and value of money, making it more stable and secure than fiat currencies, which governments issue and manage.

Self-Controlled and Self-Managed

Managing and maintaining a currency is a vital part of its growth and development. Transaction fees are paid to developers and miners for holding bitcoin transactions on their machines. Mining rewards miners for their work, ensuring that transaction records are kept up to date, ensuring that data is decentralized, and ensuring that the integrity of the cryptocurrency is maintained.

Cons

Possibility of Engaging in Illegal Activity

Keeping track of a user’s bitcoin wallet address is challenging for the authorities because of the high level of confidentiality and anonymity that bitcoin transactions provide. In spite of this, Bitcoin has been used for a variety of illegal activities, including the purchase of illegal drugs on the dark web. Additionally, some people use bitcoin to disguise the origins of their unlawfully obtained funds by converting them through a reputable intermediary.

High Possibility for Loss

A lack of control and ownership over cryptocurrency is a self-risk. If anything goes awry, you have no choice but to accept the consequences. The wallet has a problem that prevents you from protecting your bitcoins from being stolen. Because no one owns this money, you cannot claim it. You have no one to turn to if you’re having a difficulty of any kind. As a result, before purchasing a wallet, be certain that it has received positive reviews and can thus be trusted. The current cryptocurrency legislation in your nation should also be taken into account before using cryptocurrencies.

An Extremely Uncertain Market

Volatility in the Bitcoin market is high. Estimating a change in the value of bitcoin on a graph is quite difficult. It’s hard to tell when the market’s worth will go up or down in the future. Additionally, you need to be up to date on the latest bitcoin market news and trends. When it comes to investing in cryptocurrencies, you have to be ready for everything.

Cyber-hacking Risk

Bitcoin and other cryptocurrencies are very secure, but that does not apply to exchanges. Users’ wallet information is often saved by most exchanges in order to successfully operate their user ID. This information can be stolen by hackers, allowing them to get access to a huge number of different accounts. A hacker can easily transfer money from these accounts after gaining access. Bitcoin worth hundreds of millions of dollars were stolen from exchanges like Bitfinex and Mt Gox in recent years. Even though most exchanges have improved their security, a new breach is always a possibility.

There is no refund policy

Senders who transfer money to the wrong wallet address or to parties that disagree with each other will not be able to get their money back. To cheat others of money, many people can make use of this method. In the absence of a refund policy, a customer may simply be charged for a transaction for which they never received the product or service.

Final Words

If you’re still unsure about whether or not to invest in cryptocurrencies, you’re not alone. Although it depends on your goals, we feel the advantages outweigh the risks. However, while many people trade or invest in the cryptocurrency market, few people today use bitcoins to buy goods and services. It is projected that the price of cryptocurrencies will continue to grow in the future. If you’re able to put money into cryptocurrencies today, you may come to regret it later.