Fair Isaac Corporation, widely known as FICO, developed an easy method for calculating credit scores. They collect information from leading credit reporting agencies like Equifax. Most creditors use FICO scores when deciding whether to offer an individual a loan or credit card.

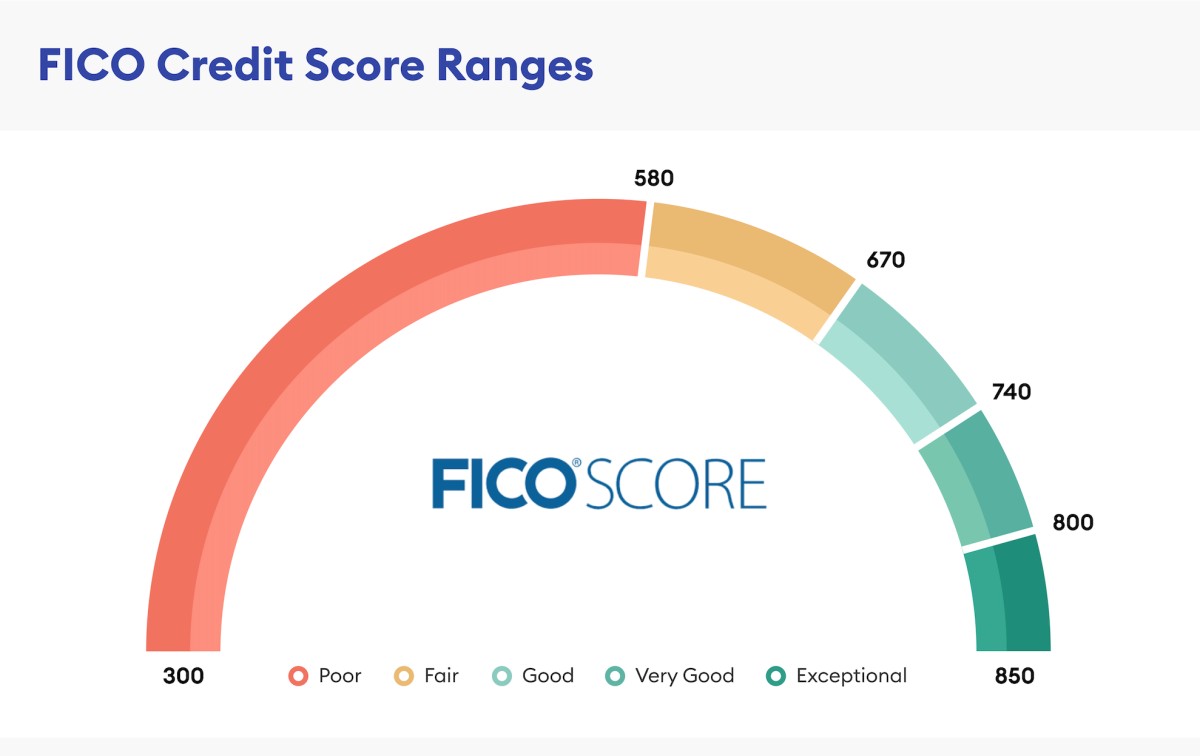

Most people look for the answer to what is a FICO credit score. It is a 3-digit number between 300-850 that helps the lenders to determine when the borrower will make the on-time payments. The FICO score also helps financial institutions and insurance companies to evaluate the risk borrowers pose.

Credit card issuers always check the FICO score before approving the individual’s requests. The higher the FICO credit score, the lower the risk you pose to creditors or insurance companies. Lenders or property managers use FICO scores to make faster decisions regarding a borrower’s creditworthiness.

Let’s learn about FICO credit scores, why it is essential and how you can improve it:

What is an Ideal Fair Isaac Corporation (FICO) Credit Score?

Borrowers with higher FICO scores have a higher chance of getting loans at a competitive rate. Now, the question is, what is a good credit score according to FICO? The ideal FICO score is above 670. Creditors and financial institutions check the borrower’s credit profile before making decisions.

The borrower will lend money if they have a FICO score between 670-740. Let’s find the ratings of the different FICO credit score ranges:

1. 540 FICO Credit Score

FICO credit scores below 600 are considered to be poor. It falls under the score range between 300-579. With this credit score, you can’t apply for loans, credit cards, mortgages or other credit types. Lenders will 100% decline your application requests.

What if you want credit with a 540 FICO credit score? You must pay additional charges or deposit extra cash on lenders’ accounts. Insurance companies might demand security money if you fail to make the monthly payments.

2. 595 FICO Credit Score

Do you have a 595 FICO credit score? You might think there is no or low chance of receiving credit from companies or lenders. The fact is that “595” is considered a decent credit score and below the average FICO score.

Many creditors approve credit applications if the borrowers have this FICO credit score. However, some lenders can decline credit requests with a 595 credit score. They might charge a security deposit to get approval for receiving instant cash.

3. 643 FICO Credit Score

Do you have a 643 FICO credit score? It is below the average Fair Isaac Corporation score. “643” is considered a fair score. Recent studies reveal that approximately 170 borrowers have a credit score below 670. It is important to mention that many lenders refuse to give credits to individuals with 643 FICO scores.

However, some lenders let you borrow money with this fair FICO credit score. Creditors or financial institutions won’t decline credit applications with a 643 credit score. They might charge a relatively high interest rate and penalty fee if you fail to pay the bills timely.

4. 658 FICO Credit Score

Most people think “658” is a poor FICO credit score, but it is not. This FICO score is below the ideal credit score and falls under the 580-669 range. It is a fair credit score that many borrowers have. With this FICO credit score, getting credit card approval might be challenging.

Some financial institutions cancel the individual’s loan approval with a 658 credit score. If any lenders or company approves your application requests, be ready to pay high interest and additional charges.

5. 685 FICO Credit Score

You can receive further credits with the 685 FICO credit score. “685” is a good credit score for applying for loans, credit cards and other financial products. This credit score falls under the 670-739 range.

A 685 FICO credit score helps borrowers get easy access to mortgages. An average of 29.2% of U.S. netizens have this FICO credit score. If you have this decent credit score, look for a reliable financial intuition to apply for loans, credit cards or mortgages.

6. 693 FICO Credit Score

693 is a good credit score, according to Fair Isaac Corporation. It falls under the 670-739 range, and many borrowers have this FICO score. Creditors accept credit applications from individuals with this decent credit score. Financial institutions also approve loans or other products if you have a 693 FICO credit score.

7. 697 FICO Credit Score

697 is a good credit score in the 670-739 range. An average of 21% of United States netizens who borrow loans have this score. Do you have a 697 FICO credit score? It means you are eligible to receive credits from insurance companies or lenders.

Every creditor considers “697” a decent FICO credit score as it poses a low-risk level. Moreover, they accept credit applications from individuals with this FICO score. Lenders might charge a moderate to lowest interest for offering credits with a 697 FICO credit score.

8. 736 FICO Credit Score

You can easily buy a house or car with this FICO credit score. Credit scores above 690 are enough to get valuable possessions. If you have a 736 credit score, it means you have a higher chance of receiving loan approvals.

It falls under the 670-739 FICO credit score range and is extremely good. Borrowers with this credit score can get credit cards and mortgages with a low interest rate.

9. 810 FICO Credit Score

810 is an excellent FICO credit score. Recent studies show that 20% of borrowers have this high credit score. 810 FICO credit score gives the individual more loan options with lower interest rates. Furthermore, you will receive easy credit card, mortgage or loan approval from the bank.

10. 890 FICO Credit Score

Fair Isaac Corporation’s credit score has a range from 300 to 855. Thus, the 890 FICO credit score doesn’t exist and is irrelevant. Usually, an 800 or above credit score is considered to be exceptional in the FICO range.

Approximately 21% of United States citizens have an 800 or above FICO credit score. This score is enough to receive loan approval from leading financial institutions. You can apply for any loan type or credit card with such a high FICO credit score.

How does FICO Measure an Individual’s Credit Score?

FICO collects the borrowers’ data from 3 main credit reporting agencies – TransUnion, Equifax and Experian. The company uses this data to calculate the consumer’s credit score.

Fair Isaac Corporation checks 5 crucial details: credit max, new credit, payment history, amount borrowed and credit history length. However, these criteria might change depending on the FICO credit score type.

They follow industry-specific credit score versions for mortgage and auto loans. FICO. So, what are these unique FICO credit score versions? These are – FICO Score 8 and FICO Score 9. FICO Score 8 is widely used for auto loan lending. The company used FICO scores 2,4 and 5 for mortgage lending.

How Can You Improve Your FICO Credit Score?

There are several ways to improve your FICO credit score easily. First and foremost, you must pay all the credit or subscription bills on time. Regularly reviewing your credit report is essential for every borrower. Besides, you must look for errors in the credit report and contact the bank for immediate support.

Check if you still need to pay monthly payments from the mobile app. If you can’t pay for some reason, contacting the creditor will be wise. Clear off the debt early by saving more money from your monthly income.

Reducing the unwanted expenditures will help you to add more money to monthly payments. Moreover, you must refrain from taking further loans or applying for a new credit card to pay off the debt. Keep the old credit card accounts active to maintain a good FICO score.