Keeping a consistent eye on your credit score is the best chance you can take at managing your financial health. Discover Bank features a credit scoreboard for users to check their FICO Credit Score. Besides checking your credit score, you can get more credit-based details with the Discover Credit scoreboard.

However, is Discover Credit Score accurate? If you have the same query, we have everything you need to know. Let’s start with what Discover Credit Scoreboard is, how it works, and how precise it is. Let’s get started.

Introduction to Discover Credit Scoreboard

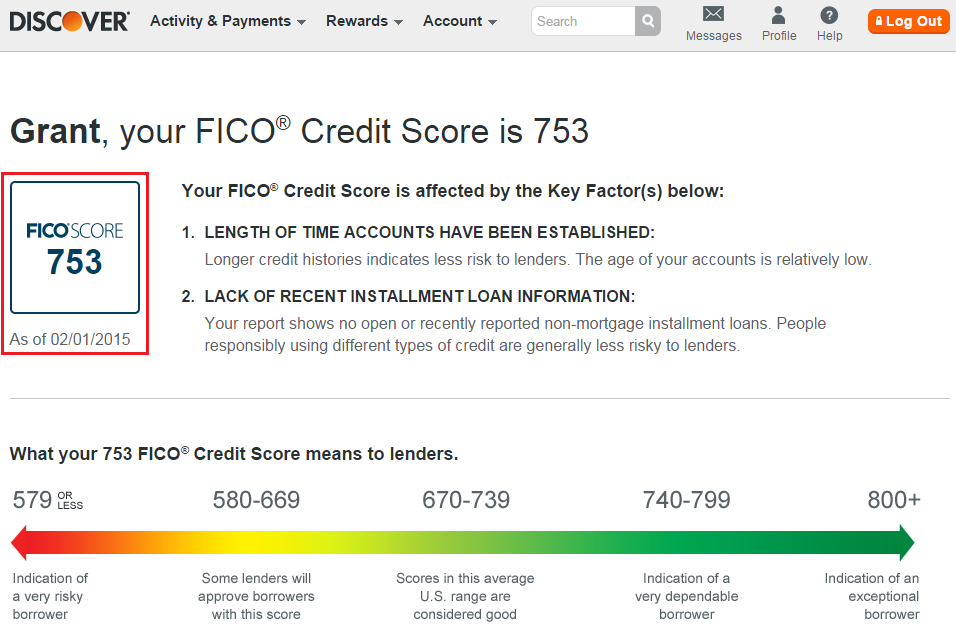

Discover is one of the most reputed and trusted credit card issuers. In addition, Discover Bank permits users or consumers to check their FICO credit score for free. Since this feature is available for free, you might need clarification about its genuineness. Is Discover credit score accurate?

We’ll discuss that later. However, you don’t necessarily have to be a cardholder from Discover Bank to check your FICO score. You can also access Discover Ban’s website to inspect your credit score from the comfort of your home.

What other details are available on Discover Bank’s website? Well, you can inquire about the following facts, such as:

- Total number of accounts

- Number of hard inquiries

- Credit history length

- Credit limits

- Missed payments and so on

Apart from this, Discover can alert its consumers about the following 3 different activities as follows:

- Social Security Number alerts will inform you if your SSN appears on any search result on the dark web. Thus, you can keep yourself away from identity theft or similar risks.

- New Account alerts notify you about your new credit cards, loans, and others appearing on the TransUnion credit report.

- New Credit Inquiry alerts appear when you initiate credit inquiries on your TransUnion credit report.

This is because these activities might negatively impact your credit score.

How can You Use the Discover Credit Scoreboard?

You may be interested in how to check your credit score in the Discover app. Fortunately, Discover Credit Scoreboard doesn’t demand any subscription or one-time fee to access the facility and check the credit score. Instead, the platform lets you review our credit score and other details for free.

Moreover, you don’t have to issue a credit card from Discover Bank to reap the benefits of the credit scoreboard. No matter how often you check your FICO credit score on the Discover app, it doesn’t harm your credit score. However, the interface only updates the FICO credit score every month.

Who can sign up for the free credit scorecard from Discover? Well, it’s only available to Discover customers. You don’t have to be a credit card bearer from Discover Bank. The same facility is available to the following beneficiaries of Discover Bank:

- Banking customer

- Credit cardholder

- Loan recipient

If you want to sign up for Discover’s credit scoreboard, then you have to provide the following details:

- Your name

- Mailing address

- Social Security Number

- Email address

In addition, you should open a free account at CreditScorecard.com to examine your FICO score from Discover’s website. Make sure that you provide a username and password to access the account. Furthermore, you must answer 4 security questions to verify your identity and finish the process.

Why Should You Use Discover Credit Scorecard?

The main advantage of using Discover Credit Scorecard is that you can keep track of your credit score from Experian for free. As you already know, Experian is one of the most reliable credit bureaus. On the other hand, the FICO credit score plays a significant role in indicating your financial status.

Most lenders and financial institutes prefer only FICO credit scores. Hence, keeping a tool handy to monitor FICO’s credit score is better. We found Discover Bank’s app compatible with inspecting the FICO credit score. Is Discover credit score accurate?

Reportedly, it is. This free scorecard offers a precise and genuine credit score. Moreover, you will get monthly updates on your FICO credit score. If you prefer checking your FICO credit score more often, Discover can be your go-to option.

Besides FICO credit scores, credit score providers like Credit Sesame, Credit Karma, etc., offer VantageScore. However, VantageScore is not the same as the FICO credit score. So, if you prefer checking the FICO score more than VantageScore, you can opt for Discover’s free credit scorecard.

Additionally, Discover lets you monitor SSN and credit monitoring. Hence, your financial details and digital identity stay safe on Discover.

How Accurate is Discover Credit Score?

Consumers have claimed that the free credit scorecard at Discover is highly accurate. However, a few users have complained that they discovered a huge gap between the displayed credit score on Discover and the actual FICO credit score report. Well, the gap was as huge as 150 points.

However, you can check your TransUnion report if you think Discover’s free credit card scoreboard might deliver you the wrong information. Still, countless consumers use the Discover app to stay in touch with their FICO credit scores. Additionally, they claim it to be accurate. After all, technical glitches are unavoidable under different circumstances. To be extra cautious, try other free yet reliable credit scoreboards.

Calculation Factors of the FICO Credit Score

Since you are excited about using Discover’s free credit scorecard, you might want to learn how FICO credit scores are calculated. Reportedly, the following information contributes to calculating your FICO credit score:

- Payment history – 35%

- Money or credit you owe – 30%

- Opening up new credit – 10%

- Timespan of credit history – 15%

- Types of credit you owe – 10%

Does Discover Credit Scoreboard Affect Your Credit Score?

Rumours revolve that checking your FICO credit score via Discover’s free credit scoreboard might negatively impact your credit score. Well, you don’t have to worry because it doesn’t. Discover lets you check your FICO credit score as often as possible.

So, there’s no upper limit on how many times you can access your FICO credit score through Discover. On a contrary note, Discover updates your and others’ credit score details only once monthly.

What about Users’ Privacy?

It’s true that Discover lets you access your credit score and other equivalent details for free on the website. However, this doesn’t mean you must deal with security and privacy issues. Is Discover credit score accurate?

Yes, it is, and so is its security and privacy policy. Discover never sells or shares consumers’ information with third-party organisations and applications. Even Discover can alert its users if their SSN appears on the dark web. Hence, you can trust Discover’s credit scoreboard for feasible access to your FICO credit score and more.

Can a Credit Freeze Stop Updates to Your Discover Credit Scorecard?

Yes, it can. Discover will be unable to update your credit score as soon as a credit freeze pops up on your credit file. As a user, you can note the changes or updates to your Discover credit scorecard from the last update before the credit freeze takes effect. However, you have to act accordingly to lift the credit freeze. Discover can only show you all the updated FICO credit scores on the credit scorecard.

Can Your FICO Credit Score be Any Different from Other Credit Scores?

Yes, it’s possible. Discover offers a FICO credit score of 8, whereas other lenders might utilise other models of the FICO credit score. In addition, Discover relies on your TransUnion credit report to decide your credit score. It can vary from Equifax or Experian data.

So, is Discover credit score accurate? Yes, most of the time, it is. Don’t forget to review your credit score frequently to keep track of your financial status and credit scope.