Google is taking big steps to make digital payments easier for people in India. The company has expanded its partnership with the Unified Payments Interface (UPI). This expansion aims to simplify digital transactions for millions of users. With new features, Google Pay will help more people access and use digital payment methods confidently.

What is UPI?

UPI, or Unified Payments Interface, is a system that allows people in India to send and receive money quickly through their smartphones. It connects different banks, making transactions easy. Users can pay bills, transfer money, and shop online with just a few taps on their phones. Since its launch in 2016, UPI has changed how people manage money in India. Today, many people prefer using UPI over cash due to its speed and convenience.

New Features from Google

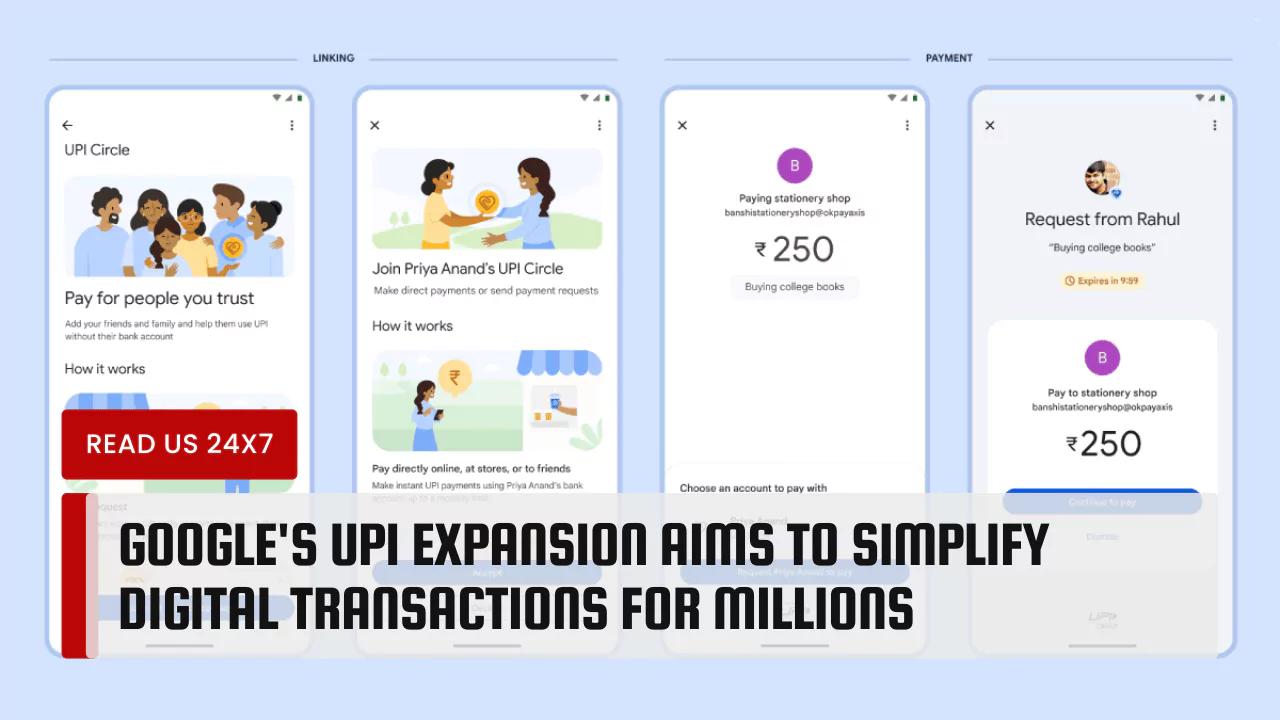

Google has introduced several new features through its partnership with UPI. One important feature is the UPI Circle. This addition lets users add friends or family members to their payment circle. Users can allow these secondary users to make payments without linking their own bank accounts. This feature is great for people who want family members to help with payments, making digital transactions easier for everyone in the household.

Another new feature is the ClickPay QR integration. ClickPay QR allows users to pay their bills by simply scanning a code with their smartphones. Instead of entering long account numbers or consumer IDs, users can scan the QR code on their bills. This process is quick and helps prevent mistakes when entering information.

Benefits of UPI Expansion

The expansion of UPI features brings several benefits to users. First, it encourages more people to try digital payments. Some users are hesitant to switch from cash due to confusion or lack of access. By offering features like UPI Circle and ClickPay QR, Google is removing barriers that prevent people from using digital payments.

Second, the new features promote safety in transactions. Many people worry about sharing personal information while making payments. UPI Circle allows users to control who can make payments and set limits. This way, users can feel more secure when using digital payment methods.

Another important benefit is financial inclusivity. Many people in rural areas face challenges in accessing banking services. The ClickPay QR feature and UPI Circle allow more people to participate in the digital economy. Users can make payments without needing a bank account, which is critical for those without access to traditional banking.

Reaching Out to More Users

Google’s goal is to reach a wider audience with the expanded UPI features. The UPI system is already popular among urban users, but many rural residents remain hesitant. Google aims to change this by simplifying the payment process. Educating users about digital payments can help increase adoption rates across India.

The UPI Vouchers program is another critical component of this effort. Users can obtain prepaid vouchers tied to their mobile numbers. These vouchers enable payments without linking a bank account. Initially launched for COVID-19 vaccination payments, the UPI Vouchers program is now useful for various sectors. This versatility supports users who may not have easy access to banking.

Google’s Commitment to Digital Transformation

Google is committed to supporting India’s digital transformation. By working closely with the National Payments Corporation of India (NPCI), the company focuses on innovative solutions that meet the needs of Indian users. As more people switch to digital payments, the need for secure, efficient methods becomes increasingly important.

The integration of UPI features into Google Pay demonstrates this commitment. Google aims to create a platform where users can manage their financial needs easily. The app helps track spending, pay bills, and send money. All these tools in one place make financial management straightforward.

Collaborating with Businesses

Google’s UPI expansion also benefits businesses throughout India. By integrating digital payment features, merchants can easily accept payments from customers. This ease of use encourages more businesses to adopt digital payment methods. Faster transactions help businesses serve customers efficiently and can even boost sales.

Many popular brands in India are already partnering with Google Pay. This collaboration allows users to make payments quickly while shopping at these stores. The variety of options for users encourages them to choose digital payments rather than cash.

Future of Digital Payments in India

Google’s initiative is an important step toward the future of digital payments in India. As more users engage with UPI, the trend toward cashless transactions will continue. Google is already exploring ways to expand the UPI system beyond India’s borders. This outreach can pave the way for similar solutions in other countries.

With digital payments becoming a regular part of life, user education is crucial. Google plans to include various resources to teach people about digital transactions. Whether it is through online tutorials or community programs, knowledge will help users feel more comfortable.