Apple Pay, the renowned digital payment service by Apple, might soon find its way to India with the launch of iOS 18. Recent leaks suggest that Apple Pay is poised to make its debut in the Indian market, offering users a seamless and secure payment experience.

Internal Leak Suggests Apple Pay Coming to India with iOS 18

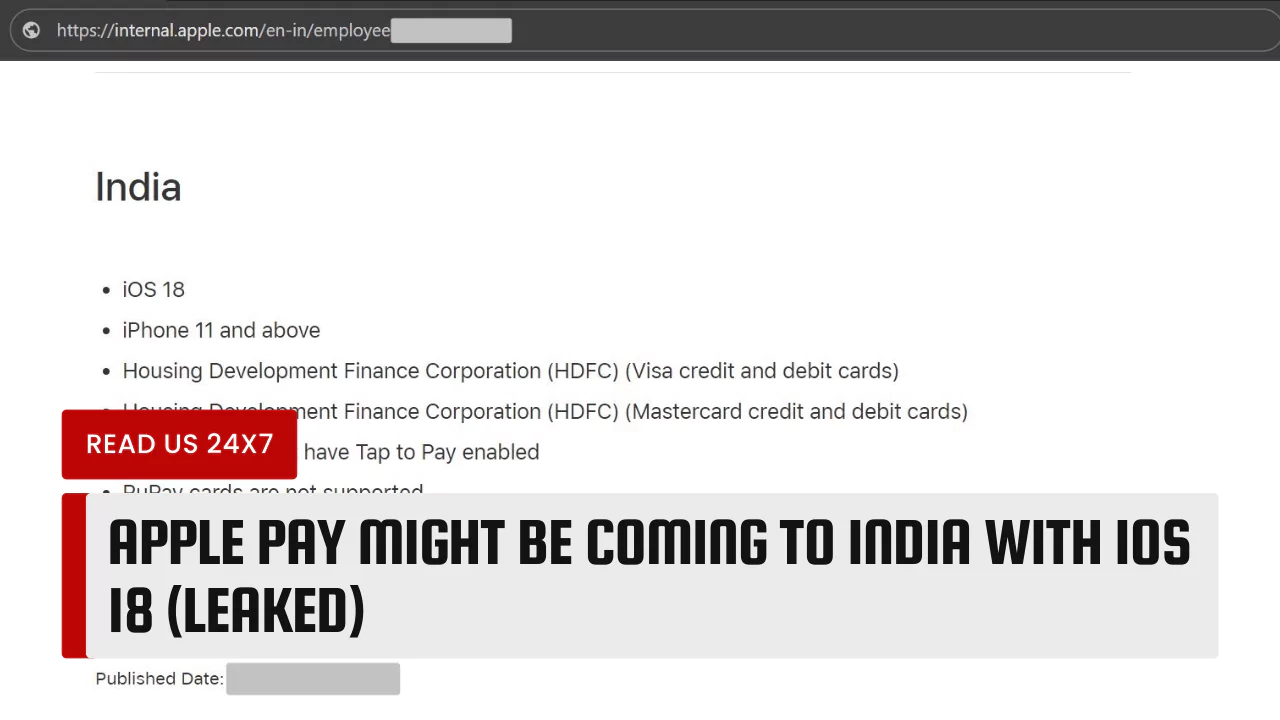

According to recent internal leaks, Apple Pay is set to be integrated into the iOS 18 update, marking its entry into the Indian market. The leaked information reveals several key details about the implementation of Apple Pay in India. It suggests that the service will initially support iPhone 11 and above models, with compatibility limited to HDFC credit/debit cards bearing the VISA and Mastercard logos. Notably, the cards must have ‘Tap to Pay‘ functionality enabled to work with Apple Pay. However, RuPay cards will not be supported initially, though there are indications that support for cards issued by other banks will be added gradually over time.

Apple Pay Features and Benefits

Apple Pay is a secure and convenient way to pay with your iPhone, Apple Watch, iPad, or Mac. It works with Face ID or Touch ID, so you don’t need to enter your PIN or password. You can also use Apple Pay to make online purchases, send and receive money, and access transit systems.

Some of the main features and benefits of Apple Pay are:

Tap and Pay

One of the standout features of Apple Pay is its ‘Tap and Pay’ functionality, which allows users to make secure and convenient transactions with a simple tap of their device. By leveraging NFC (Near Field Communication) technology, users can complete transactions swiftly and securely at supported merchants.

Virtual Card Number

Apple Pay enhances security by assigning a unique virtual card number to each transaction, ensuring that users’ sensitive payment information remains protected. This feature adds an extra layer of security, reducing the risk of unauthorized access to users’ financial data.

Availability in Stores

With Apple Pay, users can enjoy the convenience of making payments both in-store and online. The widespread availability of Apple Pay at various retail outlets and e-commerce platforms enhances the overall shopping experience, offering users a fast and hassle-free payment option.

Potential Impact on the Indian Market

Apple Pay could have a significant impact on the Indian market, where digital payments are becoming more popular and convenient. According to a report by PwC, India’s digital payments market is expected to grow from $65 billion in 2019 to $135 billion in 2023, with a compound annual growth rate of 20%.

Apple Pay could offer several advantages to Indian consumers and merchants, such as:

- Ease of Use: Apple Pay could simplify the payment process for iPhone users, who would not need to download multiple apps, scan QR codes, or enter OTPs. They could just use their devices to pay with a single tap.

- Security and Privacy: Apple Pay could enhance the security and privacy of transactions, as it does not share the card details with the merchant or Apple, and uses biometric authentication. It could also reduce the risk of card skimming, cloning, or theft.

- Loyalty and Rewards: Apple Pay could integrate with the existing loyalty and reward programs of banks and merchants, and offer additional benefits to users. For example, Apple Pay users could get cashback, discounts, or freebies from participating stores.

However, Apple Pay could also face some challenges in India, such as:

- Low Penetration of iPhones: Apple Pay is only compatible with Apple devices, which have a low market share in India. According to Counterpoint Research, Apple had only 2% of the smartphone market in India in 2020, compared to 66% for Android. This means that Apple Pay would have a limited user base in India unless Apple lowers the price of its devices or expands its compatibility with other platforms.

- Competition from Other Payment Services: Apple Pay would have to compete with other established and popular payment services in India, such as Google Pay, PhonePe, Paytm, and UPI. These services have a large network of users and merchants and offer various features and incentives to attract customers. Apple Pay would have to differentiate itself from these services and offer something unique or superior to gain traction in India.

Apple Pay is a potential game-changer for the Indian market, but it is not clear when or how it will launch in India. If the leak is true, Apple Pay could be coming to India with iOS 18, which is expected to be released in September 2024. However, Apple has not confirmed or denied the leak and has not made any official announcement about Apple Pay in India. Until then, Indian iPhone users will have to wait and see if they can use their devices to pay with a single tap.